unemployment federal tax refund update

Taxpayers who have access to a Touch-tone phone may dial 1-800-323-4400 within New Jersey New York Pennsylvania Delaware and. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits.

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

The deadline for filing your ANCHOR benefit application is December 30 2022.

. It forgives 20400 for. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000 refunds on Monday to those who qualify for the. You can also request a copy of your transcript by mail or through the IRS.

The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer had collected in 2020. THE IRS is now sending 10200 refunds to millions of Americans who have paid unemployment taxes. - scrolls down to website information.

Around 10million people may be getting a payout if they filed their tax. WASHINGTON The Internal Revenue Service announced today it will issue another round of refunds this week to nearly 4 million taxpayers who overpaid their taxes on. An immediate way to see if the IRS processed your refund is by viewing your tax records online.

ANCHOR payments will be paid. The exact refund amount will depend on the persons overall income jobless benefit income and tax bracket. The IRS reported that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust taxable income amounts based on the exclusion for.

On May 18 Gov. The unemployment tax refund is only for those filing individually. We will begin paying ANCHOR benefits in the late Spring of 2023.

A man charged with killing a woman found Saturday morning in a Seaside Heights motel was arrested after he overdosed at a nearby motel authorities said. The American Rescue Plan forgave taxes on the first 10200 of unemployment for individuals including those who are married but file taxes separately. New Jersey State Tax Refund Status Information.

File Your Taxes for Free. Henry McMaster signed into law a bill to allow South Carolina recipients of unemployment compensation to exclude from state taxes up to 10200 of. Weve filed over 50 million tax.

Amended Tax Return May Be Needed For Some Unemployed Workers Irs Says

Irs Unemployment Tax Refunds Next Batch Of Checks Timeline

Did You Get Michigan Unemployment Benefits In 2021 Don T File Your Taxes Yet Mlive Com

Where S My Refund Where S My Refund Status Bars Disappeared We Have Gotten Many Comments And Messages Regarding The Irs Where S My Refund Tool Having Your Orange Status Bar Disappearing This Has

How To Check Your Irs Refund Status In 5 Minutes Bench Accounting

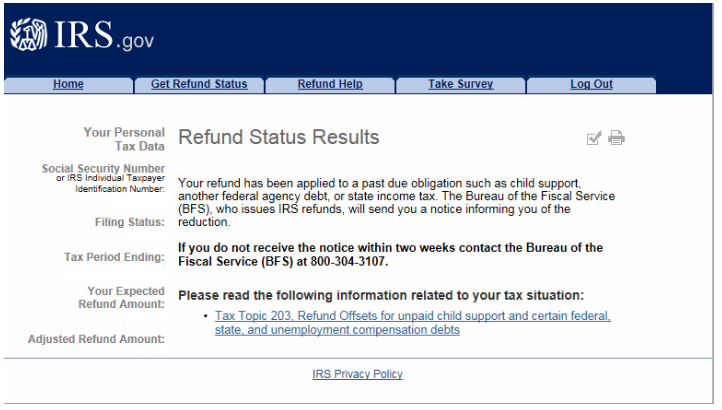

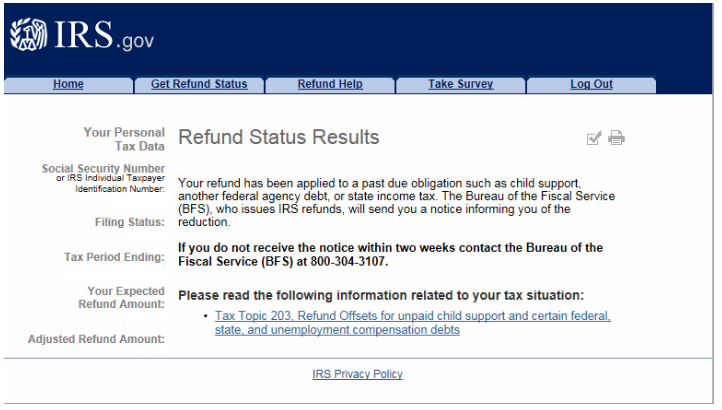

Tax Refund Offset Tax Topic 203

Tax Refund Stimulus Help Facebook

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Some May Receive Extra Irs Tax Refund For Unemployment

Angry Taxpayers See Some Extra Tax Refunds Relating To Jobless Benefits

If You Got Unemployment Benefits In 2020 Here S How Much Could Be Tax Exempt Abc News

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

I Got My Refund News Is Not All Bad Welcome C35 Club 3 5 Facebook

Tax Topic 203 Refund Offset Where S My Refund Tax News Information

Irs Refund 2021 Will I Get An Unemployment Tax Check

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Irs Still Sending Unemployment Tax Refunds

Irs Starting Refunds To Those Who Paid Taxes On Unemployment Benefits

Irs Starts Sending Unemployment Benefits Tax Refunds To Millions Of Taxpayers Plus More Special Refunds Payments On The Way